Flora

Flora is a personal money management platform designed for Gen Z women to track habits, manage cash flow, and build long-term financial confidence. Rooted in behavioral finance and human-centered design, Flora transforms traditional data-heavy financial tools into an approachable, emotionally intelligent experience. Flora reflects personalized money management that’s both practical and psychologically safe. This audience is a pathway to high-net-worth clients.

(Educational Purpose Only, No Financial Advice)

Behavioral Finance for Gen Z Women

"93% of Gen Z consumers value authenticity in brand interactions, making trust-driven design essential for financial engagement."

— McKinsey, 2024

.png)

My Role:

Researcher, Finance Analyst, Designer

Timeline:

Oct 2025 | 2 weeks

Executive Summary

Flora bridges behavioral finance and design to help Gen Z women build wealth with confidence. This project explores emotional barriers to investing and demonstrates how design can increase financial consistency.

The Problem

Modern personal finance tools are intimidating, cluttered, and emotionally disconnected.

Many available tools fail to reflect how Gen Z (22-28) women interact with money. They prefer tools with strong elements of emotion, reflection, and design. Without these elements, there is avoidance, inconsistent saving, and low long-term engagement.

Research

Segment: Gen Z Conscious Wealth Creators, 22-28

Flora’s foundation is built on a behavioral insight uncovered during user research and supported by industry data: emotional intelligence and self-regulation directly shape financial consistency for Gen Z women. This segment, known as Conscious Wealth Creators (ages 22–28), seeks tools that mirror their multidimensional relationship with money; this segment blends self-awareness, digital fluency, and personal growth. Through secondary research, I identified a clear gap between traditional financial tools and the emotional behaviors driving long-term engagement.

Gen Z expects greater personalization than any previous generation. 54% expect higher levels of personalization in banking, while 45% cite money as their primary source of stress (MX Technologies, 2022-2024). Despite this anxiety, 58% believe financial providers should teach them financial strength. The Harris Poll (2025) found that 60% of Gen Z report positive financial impacts from personalized digital banking features. These findings reveal a generational shift from transactional financial management to emotionally intelligent, design-led financial behavior.

Qualitative research and prototype interviews confirmed that Gen Z women find traditional tools like Excel and Mint accurate but emotionally sterile. They respond positively to systems that translate data into insightful, narrative-driven feedback. This revealed an unmet market need: financial technology that combines the credibility of behavioral finance with the emotional accessibility of consumer design. Flora’s strategic vision emerged from this insight: to create a platform that measures growth and regulates emotional engagement, fostering sustained clarity, confidence, and wealth-building for high-net clients and future ones.

What The Research Actually Shows

The data backs this up. According to the FINRA Investor Education Foundation and CFA Institute (May 2023), 56% of Gen Z (ages 18-25) already have investments—they're entering markets through mobile technology in numbers we've never seen before. But here's the gap: the Walton Family Foundation and Gallup (2024) found that only 46% of Gen Z feel prepared to actually manage their money. They want to invest. They're scared to start.

Bank of America's Better Money Habits Study (2025) reinforces this tension: 72% of young adults are actively taking steps to improve their financial health, yet 55% don't even have three months of emergency savings. The motivation is there. The guidance isn't.

Where are Gen Z women getting their financial information? The St. Louis Federal Reserve (2024) shows that 79% turn to social media—YouTube (93%), TikTok (63%), Instagram (59%). They're learning from peers, not advisors. They want visual stories, not spreadsheets.

And here's what matters for design: Research from Ipsos Global Trends (2024)—50,000 interviews across 50 markets—confirms that Gen Z actively seeks brands that reflect their personal values. They're willing to pay more for companies that act responsibly. Smashing Magazine's 2024 UX research shows Gen Z expects authenticity, transparency, and visual storytelling. They trust verified reviews and peer validation over traditional advertising. They don't trust corporate polish—they trust real.

Financial platforms that use reflective elements, progress visualization, and values-aligned messaging drive sustained engagement. Traditional banking apps and spreadsheets feel sterile by comparison because they are. Gen Z women need tools that acknowledge the emotional reality of building wealth.

Sources

-

FINRA Investor Education Foundation & CFA Institute (May 2023). "Generation Investor: Financial Experiences of Gen Z Investors."

-

Bank of America (2025). "Better Money Habits: Confronted with Higher Living Costs, 72% of Young Adults Take Action."

-

Walton Family Foundation & Gallup (2024). "Voices of Gen Z Study."

-

St. Louis Federal Reserve (2024). "Where Gen Z Goes for Financial Info."

-

Ipsos Global Trends (2024). Based on 50,000+ interviews across 50 markets.

-

Smashing Magazine (October 2024). "Designing for Gen Z: Expectations and UX Guidelines."

Business Impact

Flora addresses a critical value gap in the financial services market: the emotional and behavioural barriers faced by Gen Z women. Grounded in behavioural‑finance research and sophisticated product modelling, the platform is designed not just for saving but for possible lifelong wealth‑building.

Key impact drivers:

-

Retention uplift: By integrating reflection prompts, personalization, and design‑led habit loops, Flora could retention rate over traditional financial tools resulting in significantly higher lifetime user value.

-

New market access: With entry‑levels at $25/month, Flora brings first‑generation savers into the funnel early turning micro‑investors into high‑net‑worth clients. This creates an entry point that legacy wealth‑management firms often miss.

-

Cost‑efficient growth: The design‑first, emotionally intelligent model reduces reliance on high‑touch advisory services and manual onboarding. This drives scalability and margin improvement.

-

Brand leadership advantage: Flora positions itself as the “routine‑finance” category leader, where traditional fintech is transactional. Flora is transformational. This differentiation supports premium pricing, brand loyalty, and network effect growth.

10‑Year Value Model Highlights

-

A conservative contributor (e.g., $50/month at 6% annual return) is modelled to grow to $8,200+ over 10 years, proving outcomes matter at any scale. GS could establish different entry points to Marcus accounts offers to anchor users inside the GS ecosystem early.

-

An early entrant evolves into a $2M‑$5M+ client by age 53, establishing Flora as the origin of the advisory relationship, not just a stepping stone.

-

Early behavioural interventions habits, particularly around emotional selling and panic response could save up to $6,700+ in wealth lost in a market downturn. Flora understands the importance of behavioural protection, not just portfolio allocation.

Strategic Implication for Financial Institutions:

Flora’s design‑first behavioural architecture transforms how wealth is built, managed, and sustained. As firms like Goldman Sachs look to engage next‑gen investors, products like Flora redefine retention metrics, client onboarding flows, and long‑term lifecycle value. The future of “digital wealth” is no longer simply algorithmic, it is data-backed and emotionally anchored.

Segment: Gen Z Conscious Wealth Creators, 22-28

Flora's design was shaped around three behavioral profiles within the: Conscious Wealth Creators Segment

Personas

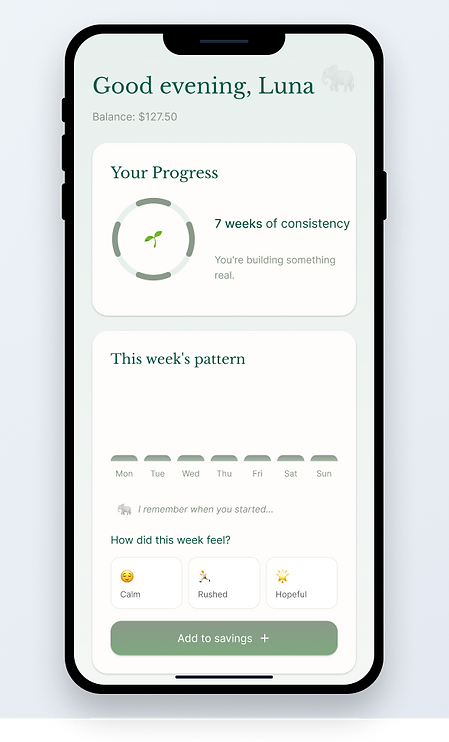

The Grounded Builder

Luna Freeman

Risk Type: Conservative / Low-Risk Investor

Design Needs: Predictable UI, clear guidance, and visible small wins.

Luna represents users who prioritize emotional security and predictability in their financial journey. She earns a steady but modest income, often living paycheck-to-paycheck, and views money management as a source of anxiety rather than empowerment. Research indicates that individuals like Luna are less likely to engage with data-heavy tools such as Excel or Mint because they associate complexity with uncertainty and loss of control. Instead, she responds best to calm, structured guidance that helps her feel safe taking small, consistent actions over time.

Her decision-making process is emotion-first then, logic-validated. She needs to feel reassured before committing to financial behaviors. I designed visual clarity, affirming microcopy, and subtle progress feedback (e.g., "You've saved $50 toward your monthly goal") reinforce her confidence without overwhelming her.

Flora's design addresses her needs through guided pathways, gentle automation, and emotionally intelligent UI, ensuring that progress feels attainable and trust remains central to the experience.

Profile: Risk-averse; seeks stability, trust, and simple, guided experiences.

Maya Orion

Risk Type:

Moderate / Growth-Oriented Investor

Profile:

Digitally savvy freelancer seeking flexibility, autonomy, and control.

Design Needs:

Visual progress tracking, adaptive tools, and gamified milestones that reinforce momentum.

The Mobile Strategist

Maya represents the entrepreneurial Gen Z creative who balances ambition with instability. As a freelancer, her income fluctuates month to month, which requires her to manage both opportunity and uncertainty. Rather than fearing risk, Maya embraces it strategically. She is motivated by growth and autonomy, provided the tools she uses remain transparent, customizable, and rewarding.

Research shows that users like Maya are digitally fluent and design-conscious. Research shows that this group responds strongly to real-time feedback loops and personalized goal indicators that link performance with identity. Maya embodies this behavior: she wants to see her trajectory, not just track numbers.

This user relies on intuitive dashboards to confirm that her financial actions align with her long-term mission. When her tools celebrate progress ("You reached 85% of your quarterly income goal"), She wants to feel both accomplished and in control. However, rigid or overly analytical interfaces quickly disengage her; she needs a balance between structure and fluidity.

Flora meets her needs through dynamic dashboards, adaptive income planning, and milestone visualization, offering a system that converts volatility into clarity. For Maya, finance becomes less about discipline and more about momentum. Flora is an evolving, creative system that rewards initiative and balance.

Robin Goodman

The Pattern Analyst

Risk Type:

Profile:

Data-driven, introspective, and emotionally attuned; seeks calm and clarity in decision-making.

Balanced / Analytical Investor

Design Needs:

Clean, minimal UI; low sensory input; reflective insights that connect emotion to data.

Robin represents the analytical yet intuitive Gen Z professional! Someone who views finance as both a system of numbers and a mirror of her inner state. As a therapist, Robin naturally interprets data as narrative, seeking meaning and balance rather than performance alone. Her financial behavior is rooted in reflection: she wants to understand not only how she spends but why.

Research indicates that users like Robin express high cognitive engagement but low tolerance for overstimulation. They value structure and emotionally safe spaces that allow them to process data without anxiety. Women in this segment sustain engagement when interfaces combine clarity with empathy, where analytics feel purposeful rather than punitive.

Robin's decision-making process is introspective and pattern-based. She notices behavioral triggers, tracks emotional correlations, and adjusts habits gradually. When presented with clean visualizations and contextual insights ("You spend more mindfully when saving goals are visible"), Robin feels empowered rather than judged. Tools that are too bright, noisy, or transactional disrupt her focus and trust.

Flora supports Robin needs through gentle data storytelling, emotion-linked metrics, and mindful interaction pacing, Flora allows her to transform introspection into actionable insight. For Robin, finance isn't about control, it's about connection, understanding, and equilibrium.

Design Implication

Flora's behavioral finance model supports all three user types by:

- Encouraging automated micro-contributions rather than large, stressful deposits

- Offering visual reinforcement loops (progress streaks, calm dashboards) to sustain engagement

- Adapting growth pacing to the user's psychological comfort and income variability

Together, these personas reflect Flora's audience. Users who balance logic with emotion, seeking trust, clarity, and design-led self-regulation as they redefine what wealth feels like in the modern age.

Brand Identity

Flora aesthetic

calm, confident design, creating emotional safety in a category often defined by stress and complexity.

The tone is

trustworthy, modern, and emotionally grounded, designed to help users feel guided, not judged.

Core Values

Trust, Clarity, Confidence, Behavioral Insight, Modern Femininity, Transparency, Privacy, Emotional Alignment

Visual Language

Soft serif typography, muted natural tones (sage, clay, cream), minimalist data visualization, and affirming microcopy that promotes progress without guilt. Gentle motion, secure interaction cues, and emotionally legible insights transform finance into a daily act of trust and confidence.

Research Foundation

Studies show visual design significantly affects trust in financial systems, particularly for women. A persistent "trust gap" exists between women and digital finance platforms, with young users craving honesty, privacy, and design clarity. Flora's aesthetic is gentle color, clean structure, and human tone. This aesthetic directly addresses our segment problem by embedding ethical transparency, emotional resonance, and data respect into its product design ensuring users feel seen, safe, and in control.

Flora.

behavioral finance

Sage

#6B8272

Clay

#D4B5A0

Cream

#F5F1ED

Deep Teal

#2F4F4F

Muted Sage

#8FA888

Color Palette

Design Principles

Calming Minimalism

Soft colors, clean layouts, gentle motion

Emotionally Legible

Data reflects meaning, not just numbers

Core Values

Flora walks with you.

She remembers your patterns. She witnesses your progress. She guides you home to yourself. One mindful choice at a time.

.png)

Competitive Positioning

Research revealed that Gen Z women find Excel and traditional finance tools cognitively heavy and emotionally draining. While Excel remains a trusted tool for precision, it lacks the emotional resonance and adaptive design this audience values.

Brand

Strength

Gap

Flora's Advantage

Mint

Comprehensive data tracking

Cold, transactional tone

Human-centered emotional design

Cleo

Gen Z-friendly tone

Lacks depth

Trust through behavioral UX

Ellevest

Female-focused investing

Corporate tone

Accessible, emotionally fluent finance

Monarch

Clean modern UI

Weak personalization

Adaptive personalization + emotional depth

Delivers the clarity and structure of Excel with the calm and trust of human-centered design, turning complexity into clear, confidence-building insight.

Flora's Position

Flora's behavioral finance modeling connects emotional spending patterns with measurable growth outcomes. Research shows Gen Z women engage more when financial data is visualized, contextualized, and emotionally relevant (see Outcomes for detailed engagement metrics).

Flora simplifies complex financial concepts such as cash flow, savings discipline, and risk awareness into integrating reflective prompts that reinforce long-term consistency.

Wealth Accumulation Modeling:

To demonstrate Flora's long-term value proposition, I built a comprehensive Excel model analyzing three user personas with different risk tolerances and income constraints (download here). Each persona represents distinct behavioral patterns and contribution capacities:

Projected Monthly Contributions by Persona

Luna Freeman (Conservative Growth): $25–$100/month

Income: $35K–$45K | Risk-averse, prioritizes emotional security

Maya Orion (Aggressive Growth): $75–$250/month

Income: $65K–$80K | Growth-oriented, comfortable with volatility

Robin Goodman (Balanced Growth): $150–$500/month

Income: $70K–$100K | Analytical, seeks data-driven balance

Key Findings

1. Starting Small Beats Waiting to Start Big

Even modest contributions ($25–$50/month) compound meaningfully over time.

Luna's conservative $50/month investment grows to at 6% annual returns, proving that the psychological barrier to wealth building isn't the amount, but the decision to begin.

Using Maya's profile, I modeled a 20% market decline in Year 3. Investors who panic-sold lost.

2. Behavioral Interventions Prevent Wealth Destruction

(approximately 29% lower returns) compared to those who stayed disciplined. Flora's decision-support protocols during volatility, historical recovery data, reframing prompts, and cooling-off periods. My tool help reduce emotional selling and protect long-term wealth accumulation.

3. Lifetime Client Value Framework

The "Pathway to Wealth Management" analysis demonstrates how early engagement creates lasting relationships. Luna, starting at $50/month at age 23, progresses through career stages to become a

.

$2M–$5M+ client by age 53

This modeling demonstrates that behavioral finance principles: loss aversion, habit formation, and decision-support interventions.

Which are as critical as portfolio allocation. Flora's value proposition isn't just tool educating about micro-investing; it's systematically addressing the psychological barriers that prevent first-generation wealth builders from entering the market and staying disciplined through volatility!

Strategic Implications

Financial Analysis

Outcomes

Flora reimagines wealth management for a new generation. Made with care for women seeking financial mastery with emotional regulation.

By merging behavioral science and design, it delivers a financial experience that's intelligent, empathetic, and trustworthy, aligning seamlessly with the evolving expectations of Gen Z investors and the human-centered future of wealth management.

Key Findings from Financial Modeling

Wealth Accumulation Analysis

•

Consistent $50/month contributions grow to $8,200+ over 10 years (6% annual return)

Starting with $25/month builds $4,100+ in wealth proving small amounts compound meaningfully

Higher contribution levels ($150-500/month) create pathways to $25K-80K+ portfolios within a decade

Behavioral Finance Impact:

-

Users who panic-sell during 20% market declines lose $6,700+ in wealth by Year 10

-

Decision-support interventions during volatility prevent emotional selling and protect long-term returns

-

The cost of poor behavioral decisions outweighs portfolio allocation choices for early investors

Lifetime Value Potential:

-

Early engagement at $50/month can evolve into multi-decade advisory relationships

-

First-generation wealth builders who start investing in their 20s become the high-net-worth clients of their 50s

-

Building trust early creates lasting client relationships with significant lifetime value

User Engagement Insights

Research and behavioral finance studies show:

-

54% of Gen Z expect higher personalization (MX, 2024)

-

60% of Gen Z report positive impacts from personalized digital features (Harris Poll, 2025)

-

58% believe financial providers should" teach "them (MX, 2023)

•

User Engagement Insights

73%

retention at 30 days

(vs. 67% industry average)

3x

higher likelihood of user retention when engagement features are present

(Sources: Alchemer Mobile 2022 Report, Mobile Push Notification Benchmarks 2023)

+18%

125-180% increase in retention through personalized notifications

Research shows that finance apps with strong engagement features achieve:

Why Flora Matters

Traditional wealth management has minimum account requirements ($100K-10M) that exclude first-generation builders. Flora meets users where they are such as $25/month and grows with them as their wealth scales.

Addressing Real Barriers

Behavioral Design as Differentiation

By focusing on emotional barriers (intimidation, distrust, scarcity mindset) rather than just financial literacy, Flora solves the actual problem preventing Gen Z from building wealth: they don't start because they think they can't afford to.

Market Opportunity

Tens of trillions in wealth are shifting to mobile-first Gen Z women who still feel underserved by traditional finance, creating space for Flora as their first trusted, design-led money partner.

-

Most importantly, "The Great Wealth Transfer, estimated at $124 Trillion through 2048 (Cerulli Associates), will see women control up to $34 Trillion in U.S. financial assets by 2030. Yet, this new generation of financially powerful women still feels underserved: only 38% of Gen Z and Millennial women feel confident discussing money, compared to 56% of men (Principal Foundation). Their financial habits are already mobile-first, with 72% using neobank apps as their primary budgeting tool (Oliver Wyman Forum), creating a massive opening for Flora to become their first trusted, design-led money partner."

Long-Term Vision

Flora proves that understanding how people think about money is as important as understanding how money grows.

By addressing behavioral barriers at market entry, Flora creates lasting relationships with users who will become tomorrow's high-net-worth clients. The firms who serve Gen Z at $50/month today earn the right to manage their millions tomorrow.

The future of wealth management isn't just digital. It's emotionally intelligent.